For many years, Utah Foundation has written about the decline in Utah’s investment in K-12 education. In the 1990s, it was common to hear about Utah’s “education paradox” – a term Utah Foundation coined to describe how a very high funding effort could yield a small amount per pupil. In 1995, for example, the proportion of income that Utahns paid for public schools ranked seventh highest in the nation, yet per-pupil funding was last in the nation. Of course, the reason for the paradox is that Utahns have big families. Even a high effort – a high tax burden for schools – would yield a low amount per student.

The paradox disappeared over time, as property tax cuts first began to chip away at the funding effort. Then the earmark of income tax was weakened, providing more flexibility in the state budget. Utah Foundation has covered this topic in briefs and reports several times. But a recent Utah Foundation report highlights a connection that was not previously apparent.

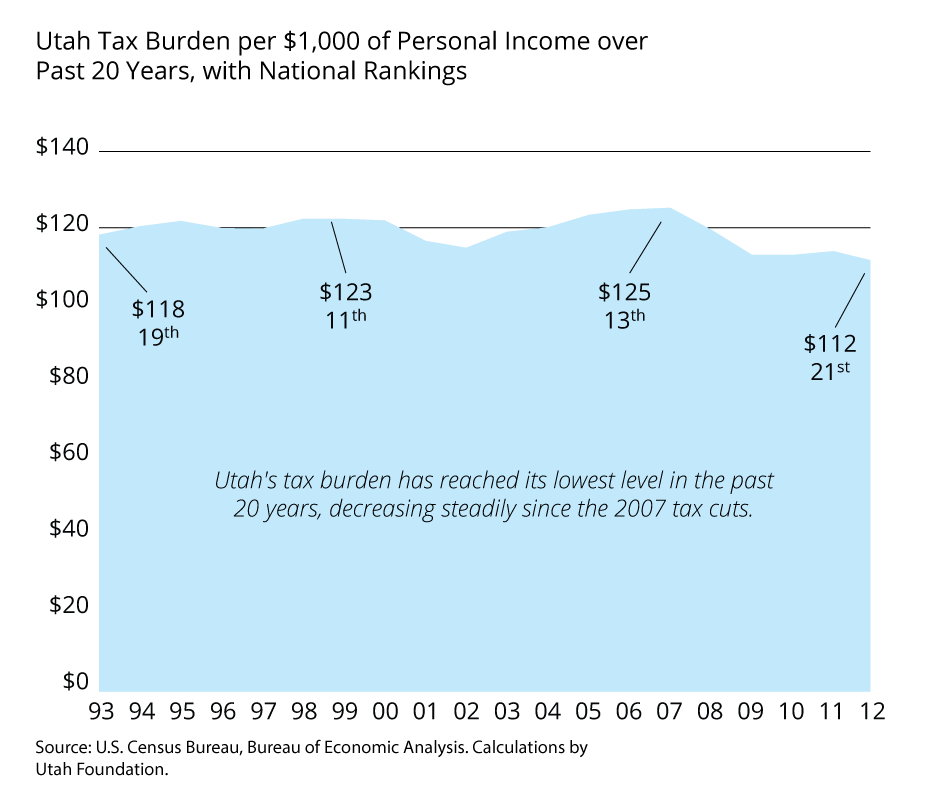

Utah’s tax burden is at its lowest level in 20 years, about $10 lower per $1,000 of personal income than in 1995, when education funding was at its peak. However, over this same period, public education funding has fallen by $12 per $1,000 of personal income. Now, the timing is different – the slide in education funding effort has occurred over two decades, while the reduced tax burden is mostly recent. Taxes were reduced significantly in 2007, largely through income and sales tax reductions. But the net effect is that, in the end, all of the burden of lowering taxes has come out of public education budgets. In fact, education funding effort has fallen more than the tax burden.

Taking a deeper look, we plotted major spending categories for all state and local government spending in Utah. Note how elementary and secondary education is the largest of all the categories, but the only one showing significant declines. Two other very small categories have also declined (natural resources and interest on debt), but they are so small that they do not impact overall state and local spending much.

What is the bottom line here? It is that the one program that is often stated to be the state’s number-one priority is the only major program to shrink as a percent of our incomes. Spending on just about everything Utah state and local governments do has either increased or held steady as Utah incomes have grown.

This outcome for public education is contrary to the stated priorities of Utah voters and many elected officials themselves. But somehow over the past two decades, our political processes have produced this result. Utahns now enjoy a lower tax burden, but over time, we have paid for the entire tax reduction through lower investment in schools.

—–

Russell Slade and Max Roth of Fox 13 News created this graphic to explain the changes: “Joe Utah” had an income of $50,000 in 1995. $6,100 of that went to state and local taxes that year and $2,700 was the funding burden for Utah’s public schools. “Joe Utah, Jr.” has an income of $50,000 in 2015. $2,100 of his state and local tax burden of $5,600 goes to public schools. Watch the story on the Fox 13 website.

Categories:

Comments:

One Response to “Public schools shoulder the burden of tax cuts”

UtahTeacher

And to further illustrate the actual decline of funding in the last twenty years, we need to remember that the decreasing percentage of the budget labeled as “Elementary and Secondary Education” on the graph now includes a duplicate system of schools, charter schools, that it didn’t until about 1999.

So look at the last chart. When the public education budget was at its highest percentage in the mid nineties, we were funding only one system. Now as the line has declined since 1999, the state budget pie is not only smaller, but we are dividing it into more pieces. Charters increase choice, but they divide efficiencies and can cap classroom size, while our traditional public schools continue to accept all comers with the decreasing amount of funding effort. So that funding decline is even worse than it looks for the schools where most of our students attend. My experience is that class sizes are worse than they were in the mid-nineties.

And no, that is not because of district administration. Our districts have less administration costs per student than 99% of districts across the country.