The sales tax is paid almost every day by virtually every person who sets foot in Utah – residents and visitors alike. It is one of the legs of Utah’s “three-legged stool” of tax revenues, along with property and income taxes.

The Everyday Tax examines Utah’s sales tax, comparing it to taxes in other states and looking at the factors affecting its growth. It also looks at exemptions and earmarks, as well as options for broadening the sales tax base.

This is the third report in Utah Foundation’s Tax Policy Series. Part 1 examined property taxes; Part 2 examined the income tax.

Download a one-page overview of this report here.

Key Findings

Key Findings

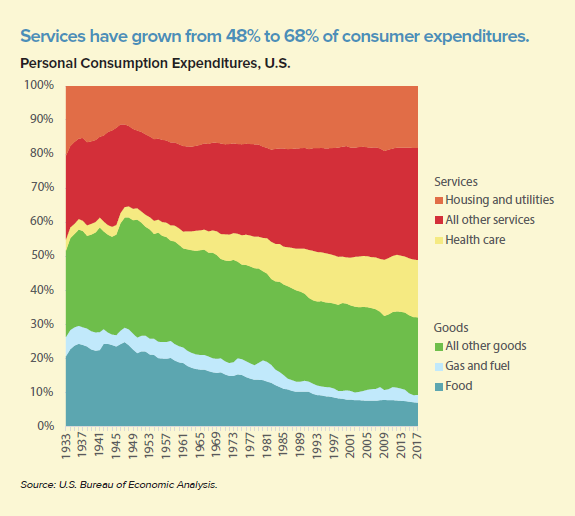

- During the past 45 years, Utah has seen the nation’s second biggest decline in taxable sales as a proportion of consumer expenditures.

- Beginning in 1975, Utah’s sales tax imposed a larger tax burden than income or property taxes. During the past

two decades it has trended downward to impose the smallest burden of the three. - Utah had essentially the same real per capita sales tax revenue in 1978 as in 2016 – meaning that, as costs

climb, the state is losing purchasing power from this revenue source. - More than 20% of the state’s sales tax revenues are earmarked – meaning the expenditures lack standard

annual legislative oversight, and the government’s flexibility to meet changing needs is constrained. - Among the nine western continental states that collect sales taxes, Utah has the lowest sales tax burden.

- If Utah broadened the sales tax base to include all personal consumption transactions, the state could drop

the effective rate to 2.1% (from 6.2% currently) and generate the same amount of revenue. - Sales taxes on services are supported by economists and policy analysts across the ideological spectrum. However, expanding sales taxes to capture services can face intense pushback from industries to be affected and from citizens who fear the change will result in net tax increases.

Key Findings

Key Findings