Utahns face at least two significant hurdles when buying a first home: high prices and relatively high mortgage interest rates. While interest rates may decline over the coming months and years, it is unlikely that prices will decrease. They might even continue to increase. This means that first-time home buyers are unlikely to revisit a level of home affordability enjoyed at various times during this or the last century. This report is focused on potential solutions to facilitate homeownership in the face of these hurdles.

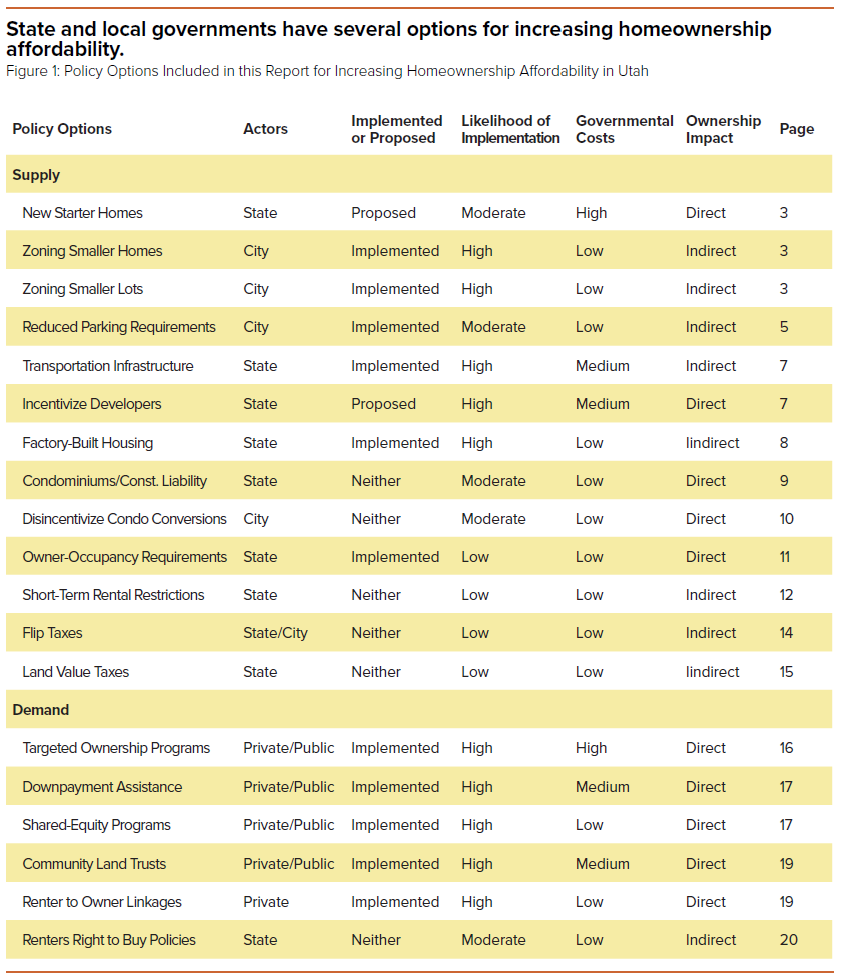

Federal programs, the state government, municipalities, private for-profit organizations, and non-profits might implement possible solutions. The alternatives discussed in this report can be broadly categorized into solutions focused on supply and solutions focused on demand. The first seeks to increase the availability of purchasable homes, while the second focuses on providing support for people looking to purchase homes.

As seen in the Utah Governor’s budget proposal for 2025 and the Utah Legislature’s actions taken during the 2024 General Session, there is no one solution to overcoming existing homeownership hurdles. Instead, various approaches across the boundaries of supply and demand for housing should be considered and likely implemented simultaneously.

Highlights of this Report

- Encouraging construction density can improve homeowner affordability as height limits are increased or smaller lots are embraced in neighborhoods otherwise characterized by single-family homes.

- Factory-built housing can be used to improve affordability as economies of scale reduce construction costs.

- Tax policies can be used to discourage housing speculation and increase the supply of ownable and rentable housing. These might include land-value, flip, and vacancy taxes.

- Shared equity models and downpayment assistance can be used to increase homeowner affordability and allow residents access to the housing ladder.

- “Not in my backyard” or NIMBY attitudes might be related to gaps in insurance product availability, which should inform municipal actions when advocating for certain housing policies.

- Various policy options can encourage condominium construction and help increase homeowner affordability.